Owning an iPhone in Pakistan often ignites a passionate debate between desire and affordability. The sleek design, intuitive interface, and powerful ecosystem undeniably hold sway over tech enthusiasts, but the hefty price tag can leave even the most ardent Apple fan feeling a tad deflated.

However, fret not, for this ultimate guide will pave the way to owning your dream iPhone through the magic of installments, offering a spectrum of options to suit your financial landscape and tech ambitions.

Table of Contents

Programs that are offering iPhone on installements in Pakistan:

National players like AlfaMall by Bank Alfalah, Faysal Bank, and PriceOye join forces with trusted financial institutions to offer 0% interest installment plans across a variety of iPhone models.

There are also some other companies that are offering iPhones on installements with a reasonable markup plans such as Surmawala and Fazal Electronics.

Local providers in your market add another layer of convenience, allowing you to browse and compare deals right at your doorstep.

Whether you crave the latest iPhone 14 Pro Max or prefer a budget-friendly pre-owned model, these platforms bring your tech dreams within reach.

Let’s discuss each of these programs..

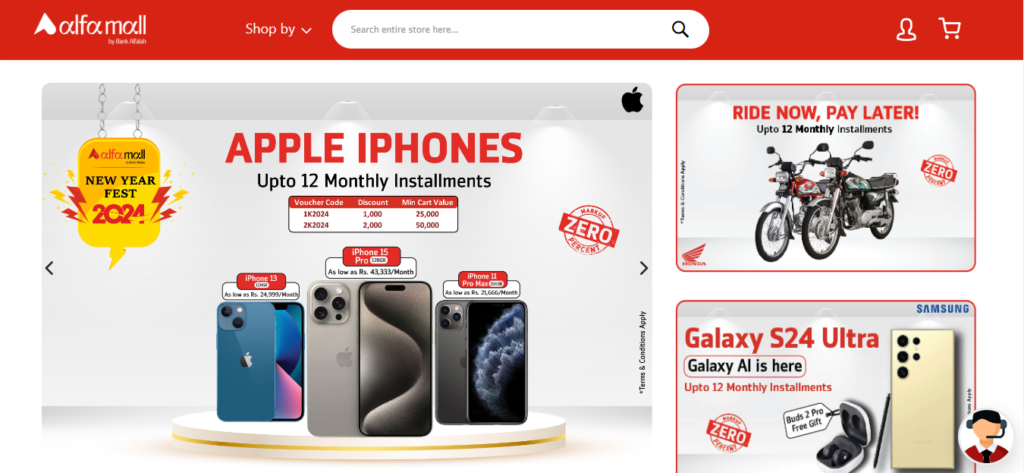

1. AlfaMall by Bank Alfalah:

AlfaMall, the online shopping platform powered by Bank Alfalah, isn’t just about dazzling deals and convenient home delivery. It’s also your key to unlocking your dream iPhone through their enticing installment program.

So, if the gleaming Apple logo stirs your tech desires but the price tag throws cold water on them, hold your horses! AlfaMall’s installment plan might just be the magic spell you need.

Eligibility Criteria:

- Bank Alfalah Credit Card Holder: This program, as tempting as it is, is exclusive to Bank Alfalah credit card holders. So, if you haven’t already, consider joining the Bank Alfalah family to open your iPhone gateway.

- Minimum Salary Requirement: To ensure responsible ownership, AlfaMall sets a minimum salary requirement for their installment plans. This varies depending on the chosen iPhone model and installment tenure, so check their website for specific details.

- CNIC and Phone Details: Keep your Computerized National Identity Card (CNIC) and the IMEI number of your desired iPhone handy, as you’ll need them for the application process.

How to apply:

- Head over to AlfaMall’s website or mobile app. Browse their selection of iPhones and choose your desired model and installment tenure.

- Click on “Buy Now” and enter your Bank Alfalah credit card details along with your CNIC and iPhone’s IMEI number. The platform will automatically evaluate your eligibility based on the minimum salary requirement.

- Sit back and relax! If approved, AlfaMall will process your order and deliver your brand new iPhone directly to your doorstep. You can then conveniently repay the cost in easy monthly installments, savoring your Apple experience one bite at a time.

2. Faysal Bank:

For tech enthusiasts in Pakistan, Faysal Bank emerges as a shining beacon, offering a path to smartphone nirvana through their flexible iPhone installment programs.

Their installment plans aim to bridge the gap between desire and affordability, making your iPhone dream a delicious reality, one bite-sized payment at a time.

Eligibility Criteria:

To qualify for your iPhone journey with Faysal Bank, ensure you tick these boxes:

- Minimum Salary: Your monthly income should meet the minimum salary requirement set by Faysal Bank. This requirement varies depending on the chosen iPhone model and installment tenure.

- Employment Stability: Be employed with a reputable organization for at least 6 months, demonstrating income stability.

- Creditworthiness: Maintain a healthy credit score, indicating responsible financial behavior.

How to apply:

- Head to Faysal Bank’s website or visit their dedicated DigiMall outlet.

- Browse through their diverse selection of iPhones available on installment plans. Remember, Faysal Bank offers both new and pre-owned models, catering to budget preferences.

- Choose your desired iPhone model, installment tenure, and down payment option.

- Submit your application online or at the DigiMall outlet, providing the required documents. These typically include CNIC, salary slips, and employment verification documents.

- Once approved, get ready to celebrate! Faysal Bank will handle the remaining payment to the retailer, and you can start enjoying your iPhone in convenient monthly installments.

3. Priceoye:

PriceOye, Pakistan’s premier online marketplace, isn’t just about browsing your tech desires; it’s about making them tangible, bite-sized realities. And what better way to turn that iPhone longing into a sleek phone in your hand than with their 0% interest installment program? Here’s how this magic trick works:

Eligibility Criteria:

To qualify for PriceOye’s iPhone installment plan, you’ll need to:

- Be a Pakistani citizen above 18 years old.

- Hold a valid CNIC (Computerized National Identity Card).

- Have a decent credit history with no outstanding defaults.

- Meet the income requirements set by the partnering financial institution.

How to apply:

- Head to PriceOye’s website or app, and browse their mouthwatering selection of iPhones.

- Choose your desired model and storage capacity. Remember, higher-end models may require higher minimum incomes.

- Select the “Installment” option at checkout.

- Fill out the online application form, providing your CNIC details, employment information, and desired installment tenure.

- Choose your preferred bank or financing company from the available options.

- Sit back and relax! PriceOye will process your application and get back to you within a few working days.

4. Surmawala:

Surmawala, a leading name in Pakistani electronics, takes your iPhone aspiration from a distant dream to a delightful reality with its Easy Installment Plan.

Gone are the days of feeling discouraged by the hefty price tag; Surmawala understands the allure of Apple and empowers you to own your desired iPhone through convenient monthly payments.

Eligibility Criteria:

To qualify for this program, you must be a Pakistani citizen with a valid CNIC and be at least 21 years old. Maintaining a good credit score with a stable income and employment history further strengthens your chances of approval.

How to apply:

- Browse and Pick: Explore Surmawala’s website or visit their physical stores to browse their available iPhone models and choose your dream device.

- Get Pre-Approved: Fill out a simple online application form providing your basic information and financial details. Surmawala’s quick and efficient system will get you pre-approved within minutes.

- Walk Away with Your iPhone: Upon approval, visit your chosen Surmawala store and pay the initial down payment (typically 30%). You can take your brand new iPhone home and start enjoying it while the remaining amount is conveniently spread across monthly installments with a 2% monthly service charge.

5. Fazal Electronics:

Fazal Electronics, a household name in Pakistani electronics, understands the burning desire for an iPhone. But affordability? They’ve got that covered too, with their installment program turning your dream phone into a delicious reality, one bite-sized payment at a time. Let’s explore how you can step into the Apple ecosystem with Fazal Electronics.

Eligibility Criteria:

To qualify for Fazal Electronics’ iPhone installment program, you must:

- Be a Pakistani citizen with valid CNIC

- Have a steady source of income

- Have a good credit history (if applicable)

- Meet the minimum order value (specific to the chosen iPhone model)

How to apply:

- Head to Fazal Electronics’ website or visit your nearest store. Browse their selection of iPhones available on installments.

- Choose your desired iPhone and installment plan. Select the tenure that best suits your budget, from 3 to 10 months.

- Fill out the application form. Provide your basic information, employment details, and desired down payment (if applicable).

- Get instant approval (subject to eligibility). Fazal Electronics partners with renowned financial institutions to offer a quick and hassle-free application process.

- Once approved, celebrate! Your new iPhone will be delivered right to your doorstep.

6. Local Providers

While national platforms like AlfaMall and PriceOye offer a convenient route to iPhone ownership, Pakistan’s bustling markets hold another secret weapon: local installment providers.

These neighborhood heroes, often nestled within bustling mobile phone hubs or tucked away in electronics shops, provide a personalized touch and cater to specific community needs. So, before you dive into the national pool, here’s why local providers might be your ideal tech matchmakers:

How do you find these local titans:

- Keep your eyes peeled: Scan your local mobile phone markets and electronics shops for installment offers. Look for specific signage or inquire with shopkeepers.

- Word-of-mouth is gold: Ask friends, family, and neighbors if they’ve used local installment providers. Recommendations from trusted sources can lead you to the right places.

- Embrace the digital sleuth: Check online forums and community groups catering to your area. People often share experiences and recommendations for local installment providers.

How to apply:

- Eligibility criteria: Each provider has its own set of requirements. Be prepared to provide basic documentation like CNIC and income proof. Some might have minimum salary requirements or specific phone models covered.

- Application process: Most local providers have simple, straightforward application processes. You might fill out a form, answer a few questions, and get approved within minutes. Be wary of providers with complex or opaque procedures.

Comparison of Programs that is offering iPhone on installments:

Here is comparison table of all above mentioned programs that offering iPhone on installments:

| Program Name | Eligibility Criteria | Down Payment | Available iPhone Models |

|---|---|---|---|

| AlfaMall by Bank Alfalah | Bank Alfalah Credit Card Holder, Minimum Salary Requirement, CNIC and Phone Details | Varies by model and tenure | Latest iPhone models (e.g., iPhone 14, iPhone 13) |

| Faysal Bank | Minimum Salary, Employment Stability, Creditworthiness | Varies by model and tenure | Latest and previous-generation iPhone models (specific models not specified) |

| Surmawala | Pakistani citizen with valid CNIC, 21 years old, Good credit score, Stable income and employment history | Typically 30% of the phone’s price | Latest iPhone models (e.g., iPhone 14, iPhone 13) |

| Fazal Electronics | Pakistani citizen with valid CNIC, Steady source of income, Good credit history (if applicable), Meet the minimum order value | Varies by model and tenure | Latest and previous-generation iPhone models (specific models not specified) |

| Local Providers | Varies by provider | Varies by provider | Varies by provider |

Additional Notes:

- Interest rates and fees can vary between programs. Be sure to compare options carefully before choosing a plan.

- Some programs require a lock-in period, so you will be unable to switch providers or plans without penalty.

- Consider your budget and financial situation carefully before buying an iPhone on installments. Make sure you can afford the monthly payments without getting into debt.

This table should give you a good overview of the different iPhone installment programs available in Pakistan. I hope it helps you find the best option for your needs!

Benefits and Drawback of getting iPhone on installments:

Purchasing a high-end phone like an iPhone can be a significant financial commitment. While saving up for full payment might be the ideal scenario, installment plans offer an alternative pathway to ownership.

Exploring both the benefits and drawbacks can help you make an informed decision about whether this approach aligns with your financial situation and needs.

Benefits:

- Spreading the Cost: Instead of a hefty upfront sum, installments break down the phone’s price into manageable monthly payments, making it easier to fit within your budget. This opens up the latest models to a broader range of income levels.

- Convenience and Flexibility: Forget about scraping together a sizeable chunk of savings. Installment plans streamline the purchase process, allowing you to own your desired phone sooner. Additionally, diverse options in terms of tenure, interest rates, and down payments cater to individual preferences and financial realities.

- Doors to Pre-Owned Options: Platforms like Faysal Bank offer pre-owned iPhones at discounted prices. This expands your budget further and makes the iPhone dream even more accessible.

- Building Credit: Consistent and responsible repayment of installments builds a positive credit history, which can be beneficial for future financial endeavors like loan applications.

Drawbacks:

- Interest Costs: While some plans boast 0% interest, others can attract significant charges, essentially inflating the phone’s final cost. Be cautious when comparing options.

- Debt Management: Overcommitting to installments can lead to financial strain. Ensure your chosen plan aligns with your income and spending habits to avoid slipping into debt.

- Lock-in Periods: Some plans have lock-in periods, restricting you from switching providers or plans before the tenure ends. Consider your future needs and flexibility before signing up.

- Down Payment Hurdle: Certain plans require a down payment, which can still be a significant upfront cost for some budgets. Factor this into your calculations to avoid surprises.

- Hidden Fees: Scrutinize the terms and conditions of any plan for potential hidden fees associated with early termination or missed payments. Unforeseen charges can disrupt your financial planning.

Weighing these benefits and drawbacks carefully will help you determine whether buying an iPhone on installment is the right decision for you. Prioritize responsible financial management and choose a plan that aligns with your budget and long-term goals. Remember, owning a phone shouldn’t come at the cost of your financial security.

Tips to be consider before applying for these iPhone on installments Programs:

With a dazzling array of options, choosing the right program can be overwhelming. Don’t fret, tech enthusiast! Here are some pro tips to navigate the installment maze and land the perfect plan for your 2024 iPhone acquisition:

- Dive into Eligibility Deep Dive: Before your heart sets on a specific program, check if you qualify. Different plans have varying requirements, like minimum income, credit score, and employment status. Scrutinize eligibility criteria beforehand to avoid disappointment.

- Interest vs. Interest-Free: This is the real deal-breaker. While some programs boast 0% markup, be mindful of hidden fees or service charges. Compare the total cost of ownership, including down payments, processing fees, and installment amounts, to determine the true “interest-free” champion.

- Tenor Tailor-Made: Don’t get caught in a repayment marathon! Choose a tenor (installment duration) that aligns with your budget. Longer tenors mean smaller monthly payments, but accrue more interest in the long run. Opt for a realistic timeframe that balances affordability with timely completion.

- Down Payment Decisions: A hefty down payment can lower your monthly installments and reduce overall interest, but it also requires a bigger initial chunk. Assess your current finances and choose a down payment that doesn’t strain your wallet.

- Provider Playbook: Research reputable retailers and mobile carriers offering iPhone installments. Compare their terms, customer service reviews, and hidden costs to find the provider that ticks all your boxes. Don’t hesitate to negotiate for better deals!

- Lock-in vs. Flexibility: Some programs lock you into a specific network or data plan for the tenor. If you value flexibility, prioritize plans that allow you to switch after the initial period.

- Read the Fine Print, Repeat: Contracts can be dense, but resist the urge to skim! Every clause matters. Analyze termination fees, early settlement options, and insurance coverage to avoid post-purchase surprises.

Beyond Installments: Owning Your Dream iPhone in Pakistan

While the alluring promise of an iPhone on installments can be tempting, exploring alternative options can make you a more informed and financially responsible consumer. Before diving into monthly payments, consider these paths to iPhone ownership:

1. Patience is a Virtue: Embrace Saving:

Instead of spreading the cost, why not gather it? Commit to a dedicated savings plan, track your progress, and celebrate reaching your goal when you can purchase the iPhone outright. This avoids accruing interest and debt, leaving you with full ownership and a sense of accomplishment.

2. Pre-Loved Treasures: Exploring the Second-Hand Market:

Don’t underestimate the magic of gently used iPhones. Check reputable online platforms, classifieds, or trusted local stores for pre-owned iPhones in good condition. You can score significant savings while still enjoying the Apple experience. Just be sure to thoroughly check the phone’s functionality and warranty status before buying.

3. Expanding Your Horizons: Embracing Other Brands:

The smartphone world is vast! Explore compelling alternatives from other brands that offer similar features and functionalities at attractive price points. You might discover a hidden gem that suits your needs perfectly, saving you money without compromising on quality or user experience.

4. Trade-In Magic: Turning Old into New:

Give your old phone a new lease on life through trade-in programs offered by retailers or carriers. They can often credit the value of your existing phone towards your purchase of a new iPhone, lowering the cost significantly. This eco-friendly option also declutters your life and lets you enjoy the latest technology.

5. Borrowing with Responsibility: A Friend in Need (and Budget):

If time is of the essence and you have a trusted friend or family member willing to help, a loan within a clearly defined timeframe and repayment plan can be an option. But remember, borrowing comes with responsibility. Ensure crystal-clear communication and timely repayments to maintain healthy relationships.

Ultimately, the path to your dream iPhone is personal. Weigh your financial situation, consider your needs and priorities, and choose the option that empowers you to own your tech experience wisely and responsibly. Don’t be afraid to explore beyond the conventional installment approach and unlock the possibilities that best suit your unique journey.

Remember, your smartphone purchase should be a joyful step, not a financial burden. Choose wisely, stay informed, and enjoy the journey to your dream iPhone!

Frequently Asked Questions

Is buying an iPhone on installments a good idea in Pakistan?

It depends on your financial situation and needs. While installments make iPhones more accessible, consider interest costs, debt management, and hidden fees. Weigh the benefits (spreading cost, convenience) against the drawbacks (debt strain, lock-in periods) before deciding.

What are the different ways to buy an iPhone on installments in Pakistan?

National platforms like AlfaMall and PriceOye offer 0% interest plans with trusted financial institutions. Other options include retailers like Surmawala and Fazal Electronics with markup plans, and local installment providers for personalized options.

What documents do I need to apply for an iPhone installment plan?

Typically, you’ll need your CNIC, salary slips, employment verification documents, and bank statements. Specific requirements may differ.

What is the average down payment for an iPhone on installments in Pakistan?

Down payments vary depending on the program, model, and tenure, but can range from 0% to 30% of the phone’s price.

What is the typical installment tenure for an iPhone in Pakistan?

Tenures generally range from 3 to 12 months, with longer periods offering smaller monthly payments but higher overall cost due to interest. Choose a realistic timeframe that fits your budget.

What are the interest rates for iPhone installment plans in Pakistan?

Some programs offer 0% interest, while others may have significant charges. Always compare the total cost of ownership, including down payments, processing fees, and monthly installments, to determine the true cost.

Can I buy a pre-owned iPhone on installments in Pakistan?

Yes, some platforms like Faysal Bank offer pre-owned iPhones at discounted prices on installments, expanding your budget and making iPhones more accessible.

Which program offers the best deal on iPhone installments in Pakistan?

There’s no single “best” program. Compare eligibility, interest rates, fees, down payments, tenors, available models, lock-in periods, and hidden costs to find the option that best suits your budget and needs.

Do local installment providers offer good deals on iPhones?

Yes, local providers can offer personalized options, tailored installment plans, and competitive deals. Ask friends, family, and check online forums for recommendations.

Can I cancel an iPhone installment plan after applying?

Cancellation policies vary. Check the contract for early termination fees or specific procedures to avoid unwanted charges.

What happens if I miss an installment payment?

Late payment fees are common. Check the contract for specific penalties and consequences to avoid financial disruptions.

What happens when I finish paying for the iPhone on installments?

The phone becomes yours completely! You can continue using it on your desired network or sell it if you wish.

Can I upgrade my iPhone to a newer model while on an installment plan?

Some programs offer upgrade options after completing the current plan. Check with the provider for specific policies.

Is it possible to negotiate the price of an iPhone on installments?

While not the norm, sometimes local providers might be open to negotiation, especially for repeat customers or bulk purchases. Be polite, professional, and willing to compromise for a better deal.

Can I use my credit card for the down payment on an iPhone installment plan?

This depends on the program and your credit card provider’s policies. Check with both parties beforehand to confirm eligibility and avoid unnecessary charges.

What happens if the iPhone I purchased on installments gets damaged or stolen?

Most installment plans don’t include insurance, so you’ll be responsible for repairs or replacements. Consider purchasing phone insurance separately for peace of mind.

Can I return an iPhone purchased on installments if I’m not satisfied?

Return policies for installment plans can be stricter than regular purchases. Carefully review the program’s return policy before committing to avoid potential difficulties.

What happens if the program offering the installment plan goes out of business?

This is a rare scenario, but in such cases, your remaining payments and contract obligations might transfer to another provider or be handled through legal proceedings.

Can I pay off the remaining amount of my iPhone installment plan early?

Some programs allow early settlements with potential fee waivers, while others might charge penalties. Check the contract for specific terms and conditions.

Are there any seasonal or promotional offers available for iPhone installment plans?

Yes, national platforms and retailers often run special promotions, discounts, or cashback offers during holidays or festive seasons. Keep an eye out for deals around Black Friday, Eid, or Independence Day.

How can I stay informed about the latest trends and updates in iPhone installment plans in Pakistan?

Follow our website, websites of phone retailers and installment providers, and subscribe to their newsletters for the latest news, deals, and promotions.

Conclusion:

Embarking on your iPhone journey in Pakistan is not just about acquiring a sleek device; it’s about navigating the financial landscape with responsibility and savvy. While installment plans offer a convenient path to ownership, remember, true empowerment lies in making informed choices that align with your budget and long-term goals.

Before diving into monthly payments, explore alternative avenues like saving, pre-owned markets, and other brands. Consider trade-in programs and responsible borrowing if time is of the essence. Remember, your dream iPhone shouldn’t come at the cost of financial strain.

Embrace the research phase, compare options meticulously, and prioritize transparency above all else. Read contracts thoroughly, be aware of hidden fees, and choose a plan that offers flexibility and aligns with your future needs.

Finally, stay informed about evolving trends and promotional offers through reliable sources. As you embark on your iPhone journey, remember, knowledge is your most valuable asset. Make informed choices, prioritize financial responsibility, and celebrate your tech acquisition with the satisfaction of a wise and empowered consumer.